Updated 8:05 PM CDT, Tue May 15, 2018

Published Under:

A vendor’s view of what opportunities lie ahead for financial marketers to capitalize on in order to claim a spot at the leadership table.

A few weeks ago, I had the immense pleasure and opportunity to attend the American Bankers Association Bank Marketing School. It was eight days of class and craziness with nearly 100 fellow marketing junkies

Throughout the school, I noticed several themes I could relate to as someone who markets to financial institutions.

Too often, strategy takes a backseat to tactics.

In a marketing planning activity, our group jumped to what channels and tactics we would use immediately. It took concentrated effort to get the focus on all of the market research our case study provided us with.

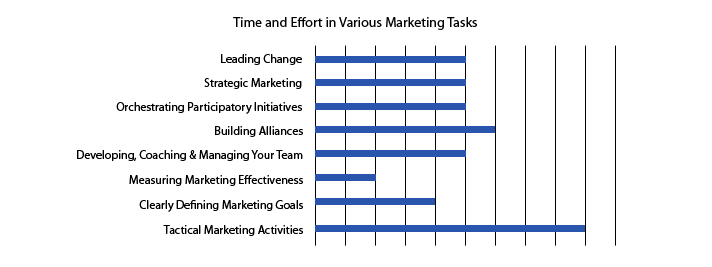

We plotted where we spend the most time and effort during a 40-hour work week. What activity received the most attention across our class? You guessed it.

Tactics are fun; they’re the “doing it” part of marketing. But the most brilliant creative assets in the world won’t get the results we want if the message doesn’t resonate because our targeting is off or completely wrong.

We can choose to be efficient or we can choose to be effective.

Joann Marsili, SVP of Marketing and Digital Sales at Fidelity Bank in Scranton, PA made a great distinction between efficiency and effectiveness during her Marketing ROI session: “Efficiency is doing things right; effectiveness is doing the right thing.”

As marketers, it is SO easy to get caught up in campaigns and marketing programs for the sake of showing we’re doing something. However, so much of what goes into being recognized as a revenue generator comes down to being effective, which means crushing initiatives that have the largest financial impact (i.e. “the right things”).

Our marketing plan will not fit to every customer type we serve.

Too often we get stuck in trying to market to everyone. We’ll never turn away business, but that doesn’t mean our precious marketing resources have to apply to every type of client. That’s how we get stretched too thin, with too many initiatives and not enough time, money or people to do any of them very well.

Knowing who our most profitable customers are helps us strategically align our resources to target other prospects just like them to drive revenue generation. As Marsili said, “Market to your best customers first, your best prospects second and everyone else third.”

Money talks. When we positively impact the bottom line on a consistent basis we will begin to be seen as a revenue generator instead of a cost center.

Underlying all of this is the need for great service delivery.

At the end of the day, we’re still trying to make connections with human beings. That’s why service delivery needs to be on point every time.

When I say service delivery, I’m talking about any time we’re interacting with customers. On the phone, via live chat, in the office, through email, at community events; the customer experience needs to be consistently great regardless of the channel it is experienced in. As Tom Hershberger put it, our brand is whatever people say it is, and that’s based off how consistently we deliver a high quality experience.

In my job, I’ve told our production team repeatedly that “we’re all in marketing” even if they’re a programmer, UI developer or UX designer not involved with our specific marketing efforts. They all touch our clients at various points, and how the client feels after that interaction is who we are to them, which greatly impacts whether they would refer us to another institution.

Overall, Bank Marketing School was an amazing experience.

Nine days spent with 90-plus bank marketers, insightful presenters and an experienced faculty was totally worth it. Not only did I walk away with tons of great insights that will allow me to serve our clients better, but also loads of great connections, conversations and memories with truly awesome people.

Comments